CRA Net Worth Audits

Situations where the CRA Performs a Net Worth Audit

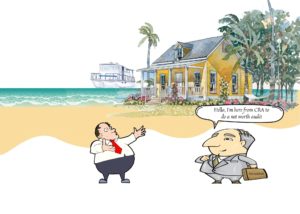

In situations where the Canada Revenue Agency (“CRA“) suspects that a taxpayer has earned more income than reported on their tax returns, the CRA can perform what is known as a “net worth audit” or “net worth assessment.” A net worth audit examines a taxpayer’s lifestyle to determine whether it is more expensive than what they would be able to afford based on the amounts declared on their tax returns.

Generally, the CRA uses net worth audits when it sees that a taxpayer has significant assets, cash or property that it suspects the taxpayer could not have purchased based on their reported income. If the taxpayer’s income is insufficient to justify his or her lifestyle, the CRA will assess the taxpayer for unpaid taxes on undeclared income and charge the taxpayer interest and penalties. Generally, those at most risk of being subjected to a net worth audit are those operating cash businesses, those who report low income or consistent losses, and those who do not keep good records.

Burden of Proof and Onus in CRA Net Worth Audits

According to subsection 152(7) of the Income Tax Act and subsection 299(1) of the Excise Tax Act, the CRA is not bound by the information provided by a taxpayer. Once a taxpayer reports his or her income by filing a tax return, the CRA has the power to assess the taxpayer. In assessing a taxpayer, the CRA can make assumptions about a taxpayer’s income and expenses, and the taxpayer has the onus to prove that these assumptions are wrong. In other words, the onus is on the taxpayer to show that the factual findings upon which the CRA based the assessment are false. This gives the CRA the power to perform a net worth audit when it determines that the taxpayer’s books and records are unreliable.

In addition, when a CRA auditor performs a net worth audit of the taxpayer under these provisions, there is a presumption in law that the CRA’s assessment is valid. In other words, a net worth audit is presumed to be valid under the law unless the taxpayer can prove that the CRA’s assessment is incorrect.

How a CRA Net Worth Audit Works

When the CRA conducts a net worth audit of a taxpayer, it creates what is known as the “net worth statement.” A net worth statement is a running balance of the taxpayer’s assets, equity and liabilities.

In calculating a taxpayer’s net worth, the CRA auditor will add up all the taxpayer’s assets (e.g. cash, property, vehicles etc.). The CRA auditor will also add to this figure all of the taxpayer’s living expenses. In situations where the taxpayer cannot provide figures for his or her living expenses, the CRA auditor will use figures from Statistics Canada. The CRA auditor will then add up all of the taxpayer’s liabilities (e.g. credit card debt, loans etc.) and subtract this amount from the taxpayer’s assets and living expenses. This amount becomes the taxpayer’s net worth.

Once the CRA auditor has determined the taxpayer’s net worth, it will look at the taxpayer’s tax returns for those years under audit. If the taxpayer’s net worth for any of the years under audit is greater than the income declared on his or her tax returns, the difference is presumed to be undeclared income. Unless the taxpayer can prove that the difference in the figures is incorrect or from another source, the CRA will assess the taxpayer for unpaid taxes, interest and possible penalties.

Defending Against a CRA Net Worth Audit

The best way to defend against a net worth audit is to reconstruct your income for the years under audit completely and challenge the CRA’s determinations of your assets, liabilities and expenses. If you have been subjected to a net worth audit, contact our firm today and book your free consultation to receive professional legal help against the CRA.

—

By Kaveh Rezaei – Attorney at KR Law Firm

**Disclaimer

This article contains information of a general nature only and does not constitute legal advice. All legal matters have their own specific and unique facts and will differ from each other. If you have a specific legal question, it may be appropriate to seek the services of a lawyer.