Corporate Taxation in Canada

What Are Corporations Under the Law?

A corporation, as defined by law, is a separate and distinct legal entity from its owners or shareholders. This separation is a pivotal feature of a corporation and is explicitly outlined in section 15(1) of the Canada Business Corporations Act (CBCA). This section equates a corporation’s legal capacity, powers, rights, and privileges with those of a natural person.

Differences Between Taxation of Individuals and Corporations

This distinct legal entity status extends to the Canadian tax system as well. Corporations, similar to individuals, must pay both federal and provincial income taxes. However, the taxation rules for a corporation differ from those for an individual. A flat tax rate applies to corporations, with the exact rate depending on the corporation’s type and the kind of income it generates. In contrast, individuals face progressive tax rates, meaning they pay more in taxes as their income increases.

If you have incorporated your business, the profits you earn from your corporation aren’t simply yours to pocket. To withdraw funds from your corporation, you need to use the methods permitted under Canadian tax laws. These methods encompass the distribution of dividends, payment of salary, capital dividend payments, repayment of capital, and shareholder loans.

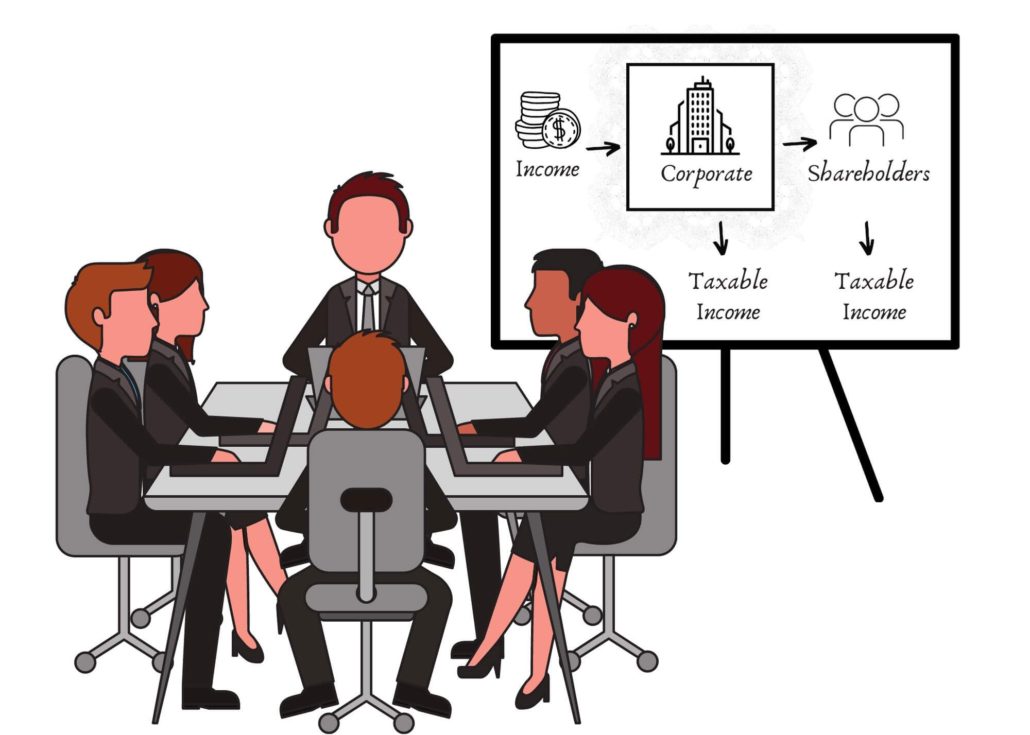

Consequently, when you generate income through your corporation, it can lead to two layers of taxation. First, your corporation pays taxes on its income at the corporate level. Next, you, as the shareholder, pay taxes on the amounts you extract from your corporation’s earned income.

Types of Corporations and their Tax Implications

Corporations can be public, private, or Canadian-controlled private corporations (CCPCs), each with its tax implications.

Public corporations meet the following criteria according to s.89(1) of the Income Tax Act (ITA):

- The corporation is a resident of Canada and has its shares listed on “a prescribed stock exchange in Canada”.

- The corporation has elected to become a public corporation and complies with certain prescribed conditions.

- The Minister of National Revenue designates the corporation as a public corporation, and it complies with certain prescribed conditions.

A private corporation, defined in s.89(1) of the ITA, has the following features:

- The corporation resides in Canada.

- It is not a public corporation.

- One or more public corporations do not control the corporation.

Lastly, a Canadian-controlled private corporation (CCPC) meets the following requirements according to s. 125(7) of the ITA:

- The corporation resides in Canada.

- The corporation has been incorporated in Canada.

- The corporation is not controlled by a public corporation or by non-residents of Canada.

Benefiting from the Small Business Deduction

A CCPC is eligible for the small business deduction (“SBD“), provided by the government to lower their tax rate. Essentially, the SBD is a percentage rate reduction from the normal corporate tax rate extended to small businesses by the Canadian government.

However, the SBD applies only to the first $500,000 of a CCPC’s active business income in any given year. Any active income earned beyond $500,000 faces the higher regular corporate tax rate.

Active Income vs. Passive Income

The SBD pertains solely to a corporation’s active business income, which includes income earned through actively participating in the business activities. Passive income, such as rent from properties, which doesn’t require active business involvement, is excluded from the SBD and faces higher corporate tax rates.

Navigating through Canadian corporate taxation can be complex and requires a thorough understanding of the law. If you need assistance or advice regarding your corporation’s taxation, don’t hesitate to book your free consultation or contact us for expert guidance.

—

By Kaveh Rezaei – Attorney at KR Law Firm

**Disclaimer

This article contains information of a general nature only and does not constitute legal advice. All legal matters have their own specific and unique facts and will differ from each other. If you have a specific legal question, it may be appropriate to seek the services of a lawyer.